The Evolution of Bitcoin: From Digital Currency to Store of Value

The Evolution of Bitcoin: From Digital Currency to Store of Value

Introduction

Bitcoin, the world’s first decentralized digital currency, has come a long way since its inception in 2009. Initially introduced as a peer-to-peer electronic cash system, it has evolved into more than just a means of transaction. Today, Bitcoin has emerged as a store of value, attracting investors and enthusiasts alike. In this article, we will explore the journey of Bitcoin and how it has transitioned from a digital currency to a store of value.

Understanding the Origins of Bitcoin

Bitcoin was created by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Its whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” was published in October 2008. The primary objective of Bitcoin was to introduce a decentralized currency that would eliminate the need for intermediaries such as banks or governments.

The Rise of Bitcoin as Digital Currency

In its early years, Bitcoin gained popularity as a digital currency. It allowed users to send and receive payments without the need for a third party. This feature, along with its low transaction fees and pseudonymity, attracted individuals seeking financial independence and privacy.

As more merchants and businesses started accepting Bitcoin as a form of payment, its value soared. Bitcoin evolved into a revolutionary digital currency that challenged traditional financial systems. However, as its adoption increased, concerns regarding its scalability and transaction speeds also surfaced.

The Store of Value Narrative

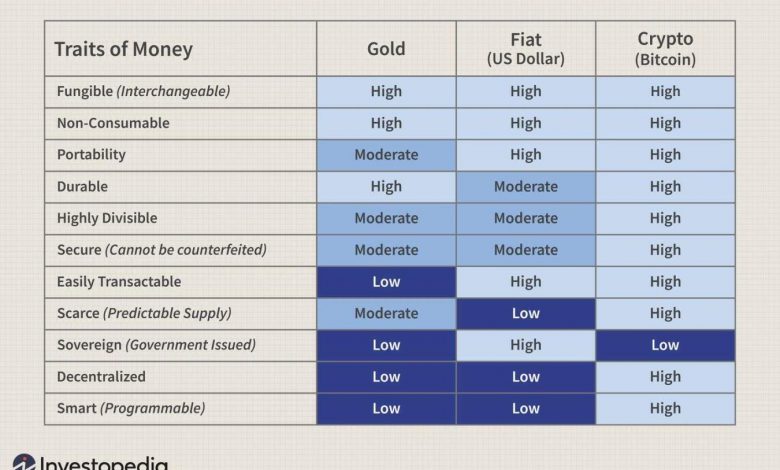

Bitcoin’s transition from a digital currency to a store of value was driven by several factors. One significant factor was the limited supply of Bitcoin. The total supply is capped at 21 million coins, making it a scarce asset. This scarcity, coupled with increasing demand, has led to a significant appreciation in its price over the years.

Another factor contributing to Bitcoin’s store of value narrative is its decentralized nature. Bitcoin operates on a decentralized network called the blockchain, which ensures transparency and immutability. This feature provides individuals with an alternative to traditional store of value assets such as gold or real estate.

Frequently Asked Questions (FAQs)

Q1: Is Bitcoin legal?

Bitcoin’s legal status varies from country to country. While some nations have embraced it and provided regulatory frameworks, others have banned or restricted its use. Before dealing with Bitcoin, it is essential to research the legal landscape in your jurisdiction.

Q2: How can I acquire Bitcoin?

There are several ways to acquire Bitcoin. You can purchase it from cryptocurrency exchanges using traditional fiat currency, mine it through a process called mining, or receive it as payment for goods and services.

Q3: Is Bitcoin a safe investment?

Like any investment, Bitcoin carries risks. Its price is highly volatile, and investors should be prepared for significant fluctuations. It is advisable to research and understand the market dynamics before investing in Bitcoin.

Conclusion

Bitcoin has come a long way since its inception as a digital currency. It has transformed into a store of value, attracting investors who see it as a hedge against inflation and a decentralized alternative to traditional assets. As the evolution of Bitcoin continues, it will be interesting to see how it shapes the future of finance and impacts the global economy.